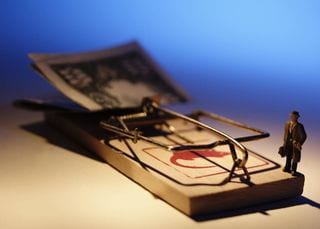

Estate law is not for amateurs! One of key parts of an estate plan is determining what to do with one of the family’s biggest assets: their home. Does it need to be protected from nursing home costs or passed to a family member? What about other assets?

Estate law is not for amateurs! One of key parts of an estate plan is determining what to do with one of the family’s biggest assets: their home. Does it need to be protected from nursing home costs or passed to a family member? What about other assets?

Investopedia’s recent article asks “Life Estate vs. Irrevocable Trust: What's the Difference?” The article explains that a life estate and an irrevocable trust are two different ways to make certain that assets are transferred to the right party. Each of these has advantages and disadvantages.

A life estate that’s used to gift property will divide the ownership between the giver and receiver. Some parents create a life estate to reduce their assets to qualify for Medicaid. While the parent still has some interest in the property, Medicaid doesn’t count it as an asset. A life estate lasts for the lifetime of its creator and it prohibits the selling of the asset, without the permission of its beneficiaries. Therefore, a parent can’t sell a home without the permission of his children, if they are beneficiaries of the life estate.

If you’re attempting to be eligible for Medicaid and are concerned that your home will disqualify you, ask your estate planning or Medicaid planning attorney about an irrevocable trust. With this trust, if a husband and wife both own a home, the husband can transfer his portion to his wife, and his Medicaid eligibility won’t include the home.

There must be a five-year gap between the creation of the trust and the application for Medicaid. If there isn’t, those funds will be counted as part of existing assets when determining Medicaid eligibility. Therefore, you can’t start an irrevocable trust right before you apply for Medicaid, if you want to receive those benefits.

One negative of an irrevocable trust is that the founder of the trust relinquishes any rights he has to the home. However, the beneficiary of the trust can’t sell the home, unless he or she is also named as a trustee. Once an irrevocable trust has been created, the trustee can’t take back control of the trust.

Remember that a life estate and an irrevocable trust aren’t always mutually exclusive. It’s possible to place an asset (like a home) in an irrevocable trust and keep a life estate. In that case, you’re irrevocably transferring ownership of your house to the trust. However, you still keep control. In this case, you are permitted to sell the home, remodel, or rent out a room, but the house itself—or the sales proceeds from it—would remain in the irrevocable trust.

In this situation, a parent would also not risk giving their children part of the tax liability that is associated with owning a home. The parent would keep more personal control over the house and wouldn’t need their child’s permission to sell the home. This may be the best option because it would still allow the parents to apply for Medicaid and not have the property count in their assets, but he or she would remain the sole decision-maker for the house.

There are pros and cons to life estates and irrevocable trust. Every situation and every family have their own fact pattern, so an experienced estate planning elder law attorney should discuss the options with the family before moving forward. Mistakes here can be costly.

Reference: Investopedia (June 16, 2019) “Life Estate vs. Irrevocable Trust: What's the Difference?”